Is Staking A Stepping-Stone to Your First Million?

When you first start in the crypto industry, it can be overwhelming because of the many different coins and ways to make money. It is easy to get frustrated with bad investments and trading. However, to confidently earn income, you should consider cryptocurrencies that have indeed proven resilient.

Even if you missed out on the early rise, it’s not too late to make money on crypto today. Armed with staking features, we’ve got some really good earning opportunities here. What’s more, staking and time are the main weapons of a passive crypto investor. In a nutshell, this is all it takes to become wealthier one day.

In this article, you’ll learn about staking crypto, what it is, and how it can be your good extra source of income.

Please note: Finscanner does not provide any investment advice, and the material is published for informational purposes only. Cryptocurrency is a volatile asset that can lead to financial losses.

What is Staking?

Cryptocurrency staking is a popular option for passive earnings on digital assets. To receive income, you need to store cryptocurrency on your account. The access of coins in the wallet allows the investor to join the project network to ensure the operability of the blockchain. As gratitude for such work, the user receives a reward in the form of a cryptocurrency.

Here we are talking about the Proof-of-Stake (POS) consensus, which has come to replace its outdated Proof-of-Work (POW) predecessor. Thus, Ethereum, the second-largest cryptocurrency in terms of capitalization, also plans to switch to the Proof-of-Stake. The transition will mark a complete change in the principle of issuing new coins.

The best association with the staking process is bank deposits. But unlike bank deposits, the staking interest rates are much higher. Plus, you, as the holder, benefit in all scenarios:

- Growing market. In this scenario, the value of the assets as well as the value of staking rewards increase. A passive crypto investor doubles his gains.

- Falling market. In this scenario, the value of the assets decreases, however, the investor offsets some of these losses with staking rewards.

Staking types

- Locked Staking

- The user chooses for what period he locks his assets on the account. For example, if the locking period is 3 months, then it will be impossible to claim rewards earlier.

With this type of staking, users receive fixed rewards. Such deposits usually have a higher interest rate, so this option is chosen by those who ultimately want to get more money.

- Flexible Staking

- In this case, the user decides when to stop participating in the validation process. Interest will be accrued until the network member cancels the staking function.

Flexible staking is suitable for those who do not like to freeze their digital funds for a long time and prefer to make flexible asset management.

- DeFi Staking

- Interest rates in decentralized finance are higher, and the entry threshold is lower. In conventional blockchains using PoS, it is difficult to earn more than 10% per year. In DeFi, the user can expect a return of 100% per annum and higher. However, the risks are also higher.

What are the rewards?

The final rate of return is determined by the choice of the coin, the staking period, and the type of staking. In most cases, payments are 2–15% per annum of the amount of assets on the account. Ultimately, the rewards depend on the risks you are willing to take.

Let’s say you decide to start making crypto with crypto and finally make more crypto with a more amount of crypto. The action process is simple here: the interest in the form of crypto, accrued on the invested capital, increases the starting size of your investments at the beginning of the next period, and hence the amount of future income. Add the potential growth in the value of the cryptocurrency itself, and you get the most result that crypto investors could ever dream of.

How big can you dream

Your desired million-dollar mark will depend on your initial investment, monthly replenishment, and the period.

Let’s take an example.

You were lucky, and you did everything as correctly as possible. You invested $5,000 to buy 1000 N tokens when the price was at the dip. The staking rate — 15%. Let’s say a bull market started, and you kept investing 700 N tokens every month whatever the price was. This wonderful scenario has lasted for 2 years. Once again, you predicted the end of the bull market and decided to stop just before the bear market began.

So what is the result?

After performing mathematical calculations and assuming that the price of your cryptocurrency has increased 10 times during the bull market, you get the coveted million!

Still don’t believe?

Well, when it comes to compound interest and bull market opportunities, everything is possible. By initially buying 1000 N tokens and replenishing 700 N tokens monthly, you accumulate about 20,099 N tokens over 2 years. With all those conditions mentioned, the total value of your assets will be around $1,005,000.

There is no guarantee

Having a clear understanding of the risks of cryptocurrencies themselves and their volatility, it is worth asking the question: “Are there any risks for cryptocurrency staking?”. Staking can provide promising profits, however, it can also lead to some notable setbacks that you should take into account before staking a cryptocurrency. Here are some risks you may find:

- Liquidity. There is no guarantee that you can convert crypto assets back to cash or other coins, as this depends on supply and demand.

- Lock-up period. There is no guarantee that your lock-up period will end before the price falls.

- Loss or theft. There is no guarantee that your funds won’t be stolen or lost because of fraud or project failure.

- Staking interest rate. There is no guarantee that the staking interest rate won’t change.

Stake crypto in 3 steps

1. Learn about cryptos that offer staking

Do proper research before starting staking. You should only buy crypto if you feel confident it’s a good long-term investment. Do not rely only on high staking interest rates as the risks are higher.

There are lots of cryptos you can consider. Here are a few of the biggest: Cardano (ADA), Solana (SOL), Polkadot (DOT). Ethereum (ETH) can also be considered in the future.

2. Choose cryptocurrency exchanges

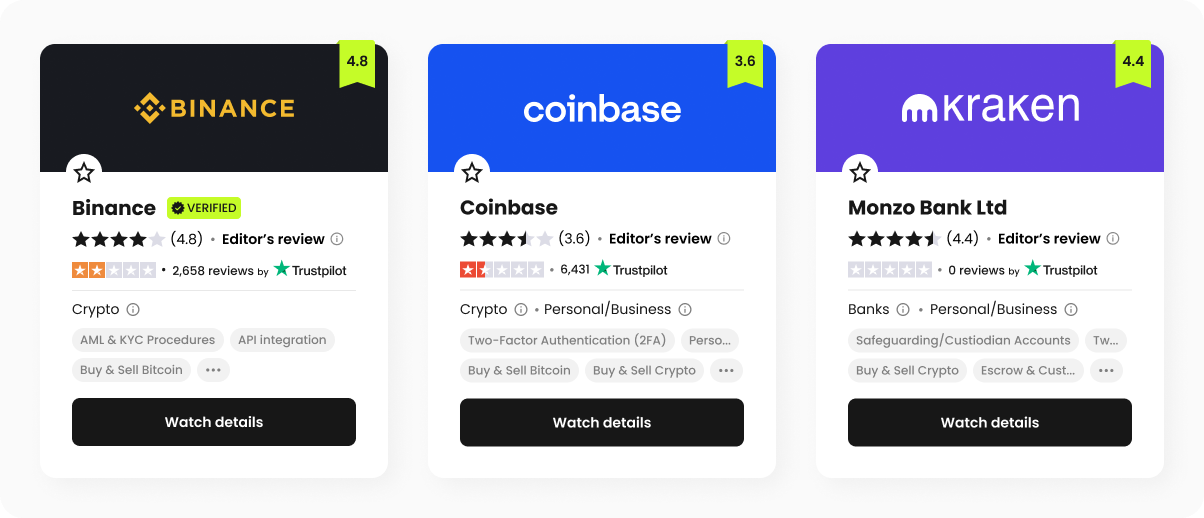

The reason why you need to carefully consider the choice of a crypto exchange lies not only in its reliability but also in the availability of a built-in staking feature. At the Finscanner Marketplace, you can find the right one. Here is a set of suitable top exchanges:

- Binance — a crypto exchange founded in 2017 by Changpeng Zhao and registered in the Cayman Islands. It is the largest cryptocurrency exchange in the world in terms of trading volume, with more than 1.4 million transactions per second. The exchange strictly adheres to US regulations, is compatible with multiple devices, and provides safe and convenient trading.

- Coinbase — a second-largest crypto exchange founded in 2012. It is based in the U.S. and has over 68 million verified users, supported in more than 100 countries. More advanced users can access additional features and order types through Coinbase Pro, available to any Coinbase user.

- Kraken — an oldest crypto exchange established in 2011, owned by Payward Inc., and is headed by CEO and co-founder Jesse Powell. It has low trading fees and a range of available cryptos that can make it a good choice for investors just starting with cryptocurrency and those who are more experienced.

3. Start staking

Once you’ve figured out what and where to buy, it’s time to research how staking works for that particular cryptocurrency. This will help you to choose the staking method that works best for you and offers the most rewards.

Find more crypto products and services at the Finscanner marketplace.

Read also

Trends of 2022 — NFT, Metaverse and GameFi

The digital currency industry has experienced accelerated growth in 2021, with many new trends emerging.

Best Crypto Payment Gateways to Connect to in 2022

If you'd like to implement innovation in your startup or business, you better be looking for transaction...